Affiliate programs in B2B fintech are not about coupons, traffic arbitrage, or one-off CPA payouts.

In 2026, the most valuable programs are enterprise referral and partner models built for professionals who influence real buying decisions.

This list focuses on programs designed for:

- PSPs and banks

- Enterprise merchants

- Fintech and SaaS platforms

- Consultants, ISOs, and system integrators

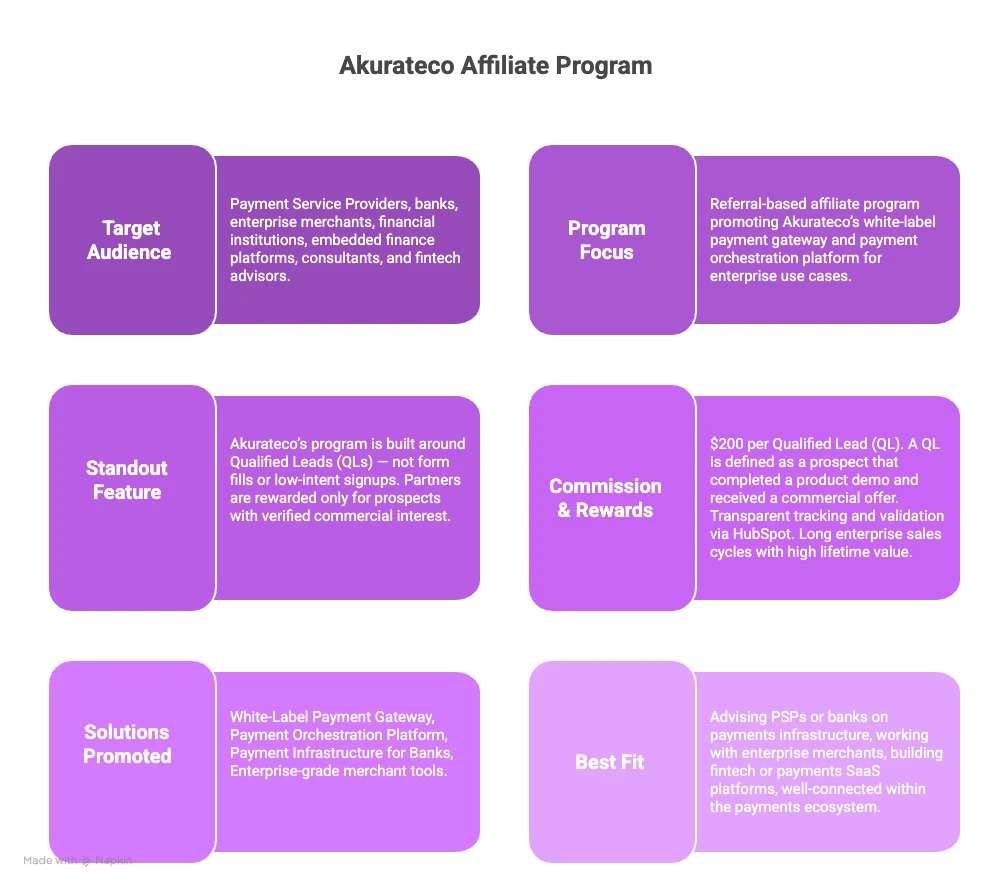

1. Akurateco — Affiliate & Partner Program

Who it’s for

Payment Service Providers (PSPs), banks, enterprise merchants, financial institutions, embedded finance platforms, consultants, and fintech advisors.

Program focus

A referral-based affiliate program promoting Akurateco’s white-label payment gateway and payment orchestration platform for enterprise use cases.

Why it stands out in 2026

Akurateco’s program is built around Qualified Leads (QLs) — not form fills or low-intent signups. Partners are rewarded only for prospects with verified commercial interest.

Commission & rewards

- $200 per Qualified Lead (QL)

- A QL is defined as a prospect that:

- Completed a product demo

- Received a commercial offer

- Transparent tracking and validation via HubSpot

- Long enterprise sales cycles with high lifetime value

Solutions you promote

- White-Label Payment Gateway

- Payment Orchestration Platform

- Payment Infrastructure for Banks

- Enterprise-grade merchant tools

Best fit if you are:

- Advising PSPs or banks on payments infrastructure

- Working with enterprise merchants

- Building fintech or payments SaaS platforms

- Well-connected within the payments ecosystem

2. Unlimit — Unlimit Business Partner Program

Who it’s for

Independent Software Organisations (ISOs), consultancies, referral agencies, independent advisors, system integrators, and non-integrated PSPs.

Program focus

A revenue-driven business partner and referral programme enabling partners to unlock new income streams while enhancing their service offering with global payment capabilities.

Why it stands out in 2026

Unlimit’s partner model is designed for B2B professionals, not mass-market affiliates. It rewards industry players who already work with merchants, PSPs, or platforms and can introduce meaningful business opportunities.

Partner types supported

- ISOs

- Affiliates

- Consultancies

- PSPs

- System Integrators

Revenue model

- Referral-based revenue share

- Long-term monetisation linked to merchant activity

- Focus on enterprise and high-value accounts

Best fit if you are

- Consulting merchants on payments or expansion

- Integrating or reselling fintech infrastructure

- Working with PSPs that need broader acquiring or APM coverage

3. Rapyd — Payment Partner Programme

Who it’s for

Referral agents, consultants, Independent Sales Organisations (ISOs), Payment Facilitators (PayFacs), and Integrated Software Vendors (ISVs) serving merchants across eCommerce, iGaming, online gaming, financial services, and digital platforms.

Program focus

A partner-led payments programme enabling professionals and platforms to solve global payment needs for their merchants using a single, unified payments infrastructure.

Why it stands out in 2026

Rapyd combines direct card acquiring licenses with a global network of 900+ payment methods, allowing partners to support both online and in-store payments through one integration, one reconciliation, and one settlement flow. The programme is built for long-term partnerships rather than one-off referrals.

Partner types supported

- Referral Partners & Consultants

- Independent Sales Organisations (ISOs)

- Payment Facilitators (PayFacs)

- Integrated Software Vendors (ISVs)

Revenue model

- Partner commissions and revenue share

- Transaction-based monetisation for ISVs

- Long-term commercial relationships rather than fixed CPA payouts

Why merchants choose Rapyd

- Directly licensed Visa and Mastercard acquirer in the UK, EU, and Singapore

- Top-20 Visa Acquirer and leading global Mastercard Acquirer

- Trusted by 250,000+ merchants worldwide

- Payments, payouts, and multi-currency business accounts from a single platform

Best fit if you are

- Managing payments for global or high-risk merchants

- Operating as an ISO or PayFac needing global acquiring coverage

- Building software platforms that embed payments

- Advising merchants on scalable, multi-market payment infrastructure

4. Nuvei — Partner & Referral Program

Who it’s for

Integrated Software Vendors (ISVs), Independent Sales Organizations (ISOs), platform partners, referral partners, consultants, introducers, associations, and professional networks working with merchants across multiple industries.

Program focus

A flexible, multi-model partnership program designed to help partners accelerate merchant growth, unlock new revenue streams, and embed scalable payment capabilities into platforms, software, and service offerings.

Why it stands out in 2026

Nuvei offers one of the most comprehensive and mature partner ecosystems in global payments, supporting partners at every stage of business maturity — from simple referrals to deep platform integrations and joint go-to-market initiatives.

Partner types supported

- Integrated Software Vendors (ISVs)

- Independent Sales Organizations (ISOs)

- Platform Partners

- Referral Partners

Revenue model

- Flexible revenue-sharing and commission structures

- No earning caps for referral partners

- Ongoing monetisation tied to merchant performance

- Transparent monthly reporting via online dashboards

Partner benefits

- Developer-friendly APIs, SDKs, and modular payment solutions

- Automated underwriting and fast merchant onboarding

- Solutions for online, in-store, and mobile payments

- Sales enablement, marketing assets, and campaign support

- Co-sales and co-marketing programs

- Back-office tools, reporting, and performance insights

Best fit if you are

- Building SaaS, marketplaces, or commerce platforms

- Managing merchant portfolios as an ISO

- Referring enterprise or mid-market merchants

5. payabl. — Partner & Affiliate Program

Who it’s for

Agencies, affiliates, payment partners, platform and embedded partners, payment facilitators, introducers, and businesses working with merchants across Europe.

Program focus

A revenue-driven payments partnership programme enabling partners to introduce merchants to a full-suite European payments provider and earn ongoing revenue share while supporting clients with local expertise and strong acceptance rates.

Why it stands out in 2026

payabl. combines regulated EU payment infrastructure with flexible partnership models and hands-on support. Unlike mass affiliate programs, this is a merchant-first, long-term partner model designed for professionals who actively manage or advise merchant relationships.

Partner types supported

- Agency / Affiliate Partners

- Payment Partners

- Platform Partners

- Embedded Partners

- Payment Facilitators

- Introducers

Revenue model

- Attractive revenue-share per referred merchant

- Flexible and customisable pricing structures

- Long-term monetisation aligned with merchant activity

Partner benefits

- Discounts on payment and banking solutions for partners and clients

- Priority access to onboarding, account management, product, and development teams

- 24/7 technical support, 365 days a year

- Fast, simple integration and speedy merchant setup

Why merchants choose payabl.

- Fully regulated EU payment institution

- Global coverage with above-average acceptance rates

- 360° payment solutions: acquiring, issuing, APMs, and banking services

- Local on-the-ground support across the UK, Germany, Spain, Italy, Portugal, Poland, Lithuania, and Cyprus

- Trusted by leading eCommerce platforms and brands

Best fit if you are

- Managing or advising European merchants

- Operating as an agency, introducer, or PayFac

- Building or supporting eCommerce and payment platforms

- Looking for a reliable EU-based payments partner with strong revenue-share mechanics

Conclusion: Why These Programs Matter in 2026

Affiliate and partner programs in fintech are evolving — and not all of them are created equal.

The programs featured in this list share a common trait: they are built around real business influence, not traffic volume. Instead of rewarding clicks or low-intent signups, these models focus on qualified introductions, long-term partnerships, and enterprise-grade infrastructure.

What sets these programs apart in 2026 is their alignment with how payments businesses actually grow:

- through trusted advisors, not mass marketing

- through complex, high-value deals, not impulse purchases

- through shared success, not one-off commissions

As payments become increasingly strategic — embedded deeper into platforms, marketplaces, and global commerce — partner-led growth is no longer optional. It’s becoming one of the most effective go-to-market strategies in B2B fintech.

If you work with merchants, PSPs, banks, or fintech platforms — and you influence real buying decisions — these are the programs worth paying attention to.